Revised: 02/08/2023

Understanding Invoices

Overview

An invoice or bill is a document issued by a seller / supplier / payee to the buying agency, indicating the products, quantities, and agreed prices for products or services the seller has provided to the buying agency.

An invoice indicates the buying agency must pay the seller, according to the payment terms. The buying agency has a maximum amount of days to pay for these goods and is sometimes offered a discount if paid before the due date.

The state is required to pay all suppliers within 30 days of receiving a proper invoice. Upon receiving an invoice, the person who received the goods and/or services should review the details to ensure that the goods and/or services were received, and the invoice is accurate.

- Do not accept hand altered invoices or adjustments to the invoice or total to be paid. Exception: If state sales tax is included on the invoice it may be altered to exclude the payment of tax. Sales tax is the only adjustment permitted on the invoice.

- Some goods and services require backup documentation to be included with the invoice. Click here to view a list of the required backup documentation needed.

Proper Invoice

Ohio Revised Code, section 125.01 B requires that an invoice includes all of the following:

- The date of the purchase or rendering of the service,

- An itemization of the things done, material supplied, or labor furnished,

- The sum due pursuant to the contract or obligation.

Agencies are responsible for providing prompt payments to suppliers / payees that provide various products and services; therefore, agencies must ensure invoices have adequate information that allows for appropriate review and approval. Examples of information that may be necessary are:

- Purchase order number(s)

- Contract number

- Agency name

- Agency billing address

- Delivery location of goods or services

- Supplier / payee name

- Supplier / payee payment remittance address

- Unique invoice number

- The date that services were provided or that items were shipped

- Invoices missing criteria to allow for appropriate level of review should be returned to the supplier / payee within 15 days of receipt of the invoice.

- OBM State Accounting will deny vouchers that have an invoice that does not adhere to Ohio Revised Code, section 125.01 (B).

- Invoices cannot be altered except for removal of state of Ohio sales tax and unauthorized freight charges.

Standard Invoices

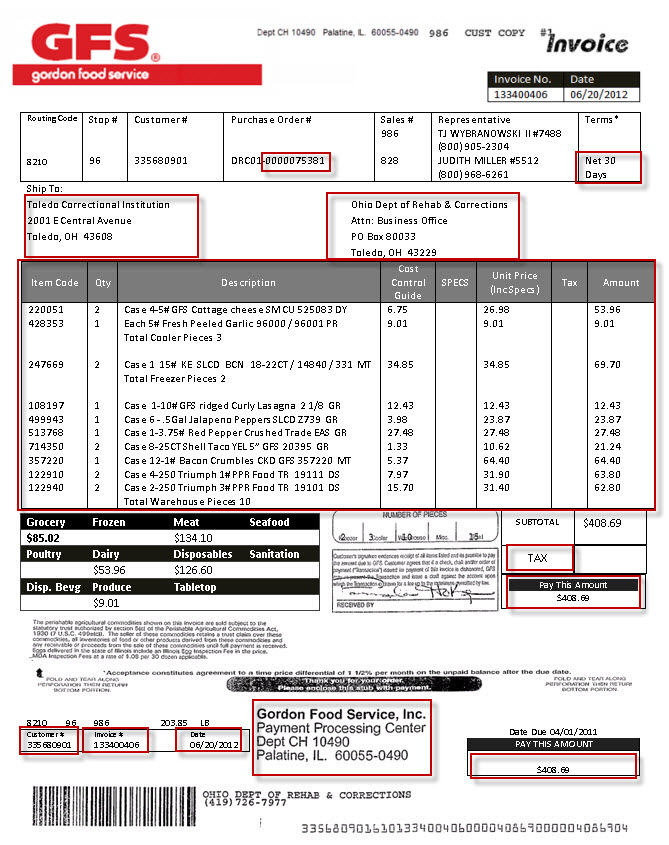

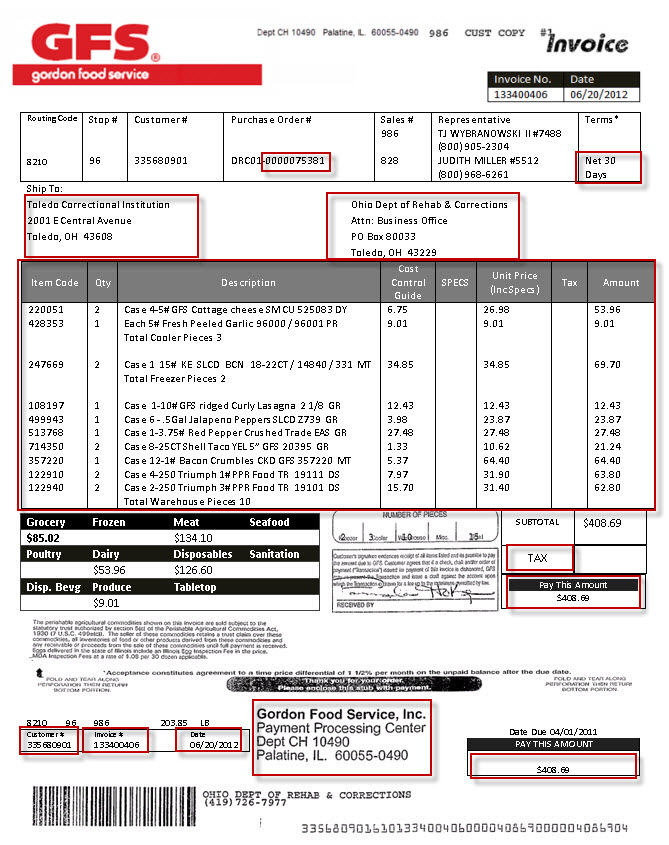

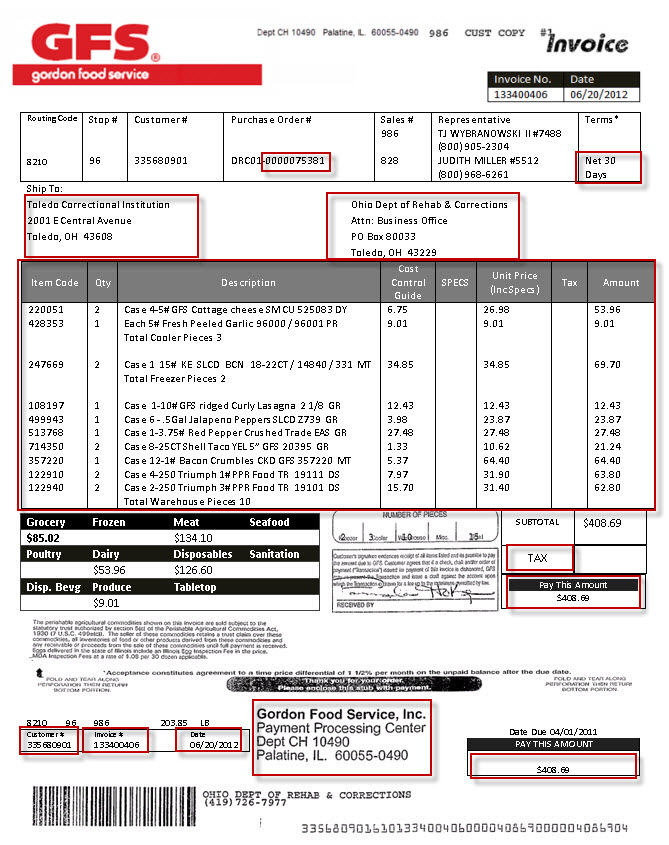

Explore the invoice below by clicking on the boxed areas.