Revised: 09/15/2022

Previous steps - "Processing Errors"

The Excel macros and XLSM template files needed to create GL journal files for payroll correction can be found on the OBM website under Forms/Spreadsheet Journal Upload Files at obm.ohio.gov/Forms. The Excel files contain a macro that the user will use to create, edit and save a journal, and the XLAM file is used to run the Excel macro. Both of these files will be stored together within the same directory. For example, the Excel macro and XLSM file for the Budget Journal Spreadsheet Upload will be stored together in the same sub-folder and the Excel macro and the XLSM file for the GL Journal Spreadsheet Upload will be in their own sub-folder on the users computer desktop or local drive.

To find a query, Search By "Query Name."

Enter "%JRNL%" in the begins with field.

The percent sign will search for the term anywhere in the query name, not just the beginning.

Click Search.

View the list of query results.

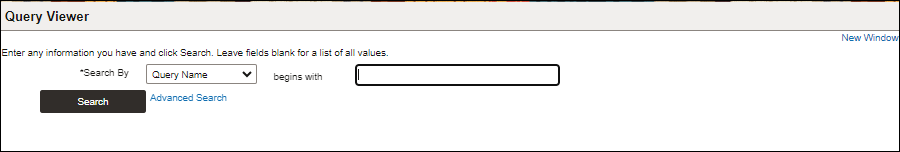

Click to open the OH_PY_JRNL_QUERY to create a spreadsheet of the original payroll journal.

Run in Excel format.

Enter the Journal ID.

The payroll journal spreadsheet opens.

Do not close this spreadsheet. Columns will be copied from the query results.

Click Enable Editing.

Correct the fields in error in the spreadsheet.

Save the changes.

The amount balance of the expense lines in the correction journal must equal the amount from the original system-generated payroll journal.

Follow these instructions to download the Excel XLAM file used for macros and the XLSM template file needed to create GL journal files for payroll correction.

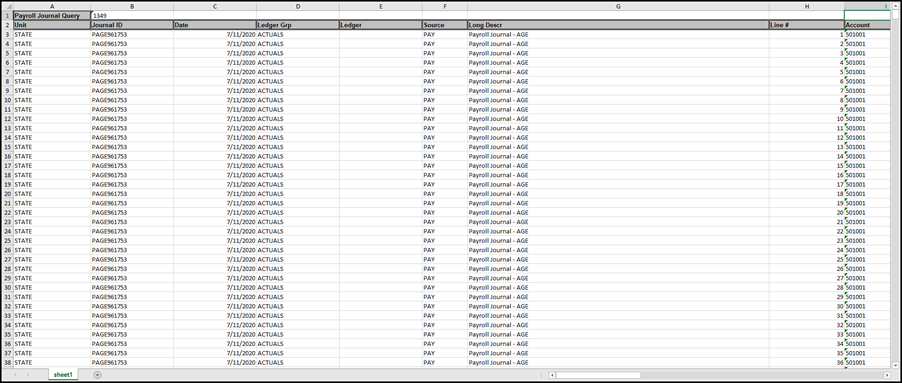

Open the Spreadsheet Journal Import template (.xlsm file) from the desktop or drive where it is stored.

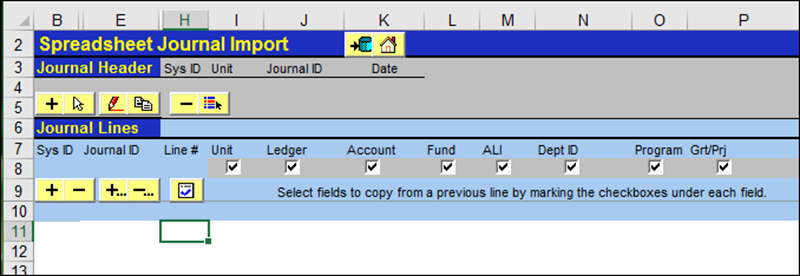

The Spreadsheet Journal Import template displays.

Click New.

Give the New Journal Sheet a name.

Click OK.

A new GL Spreadsheet Journal Import sheet displays.

Click the add sign in row 5.

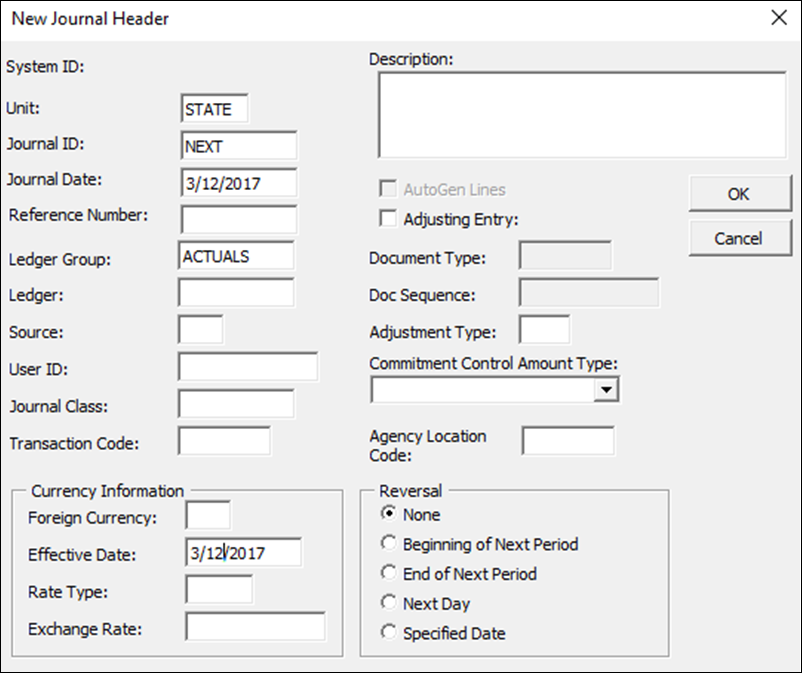

The New Journal Header page displays.

Click OK.

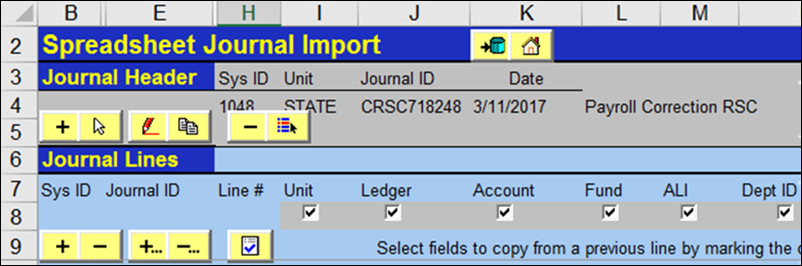

The GL Journal Spreadsheet displays with header completed.

Click the Insert Multiple Lines button on row 9.

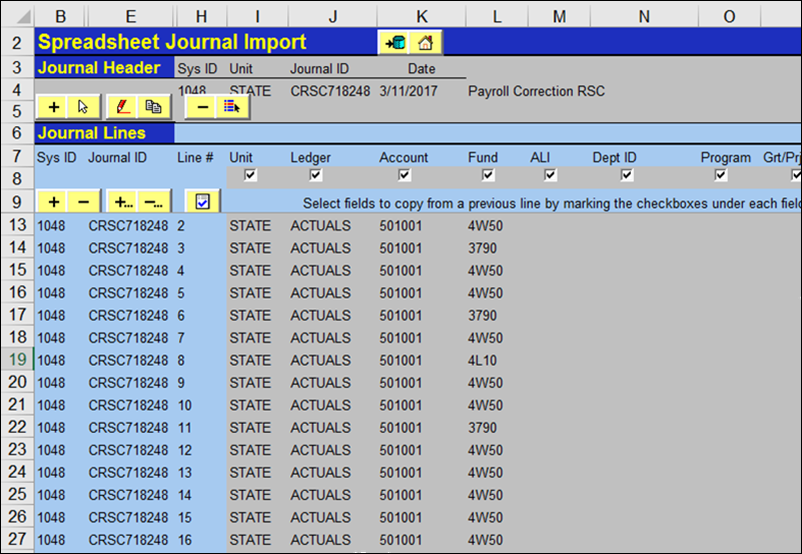

Enter the Number of Lines that are necessary for the journal correction (i.e.,the same number of lines on the downloaded spreadsheet from OH_PY_JRNL_QUERY or from the Review Journal Status OAKS FIN inquiry).

Some lines from the original payroll journal may have been combined.

Copy columns, one at a time ( ), from the spreadsheet or table generated from an OAKS FIN inquiry or query.

), from the spreadsheet or table generated from an OAKS FIN inquiry or query.

Include all rows with data on the spreadsheet not just the adjusted lines.

The corrected payroll journal takes the place of the original PAY journal.

The column order on the query may be different than the column order on the spreadsheet journal lines.

Paste (paste as values) each column into the GL Journal template.

The exception to steps 25 and 26 is that when using the OH_PY_JRNL_QUERY, the columns in the query are in the same order as the spreadsheet journal. All lines and columns that contain data can be copied from the query and pasted into the spreadsheet journal at one time.

Review the journal template and make any additional corrections.

Change only expense lines (begin with "5"). Do not change or remove liability lines (begin with "2"). Cash lines (begin with "1") will automatically be added in the edit process to balance the Fund.

Save the file.

Click the Home icon.

Next steps - "Updating and Submitting"