Effective: 09/03/2019

Meal per diem is an allowance for breakfast, lunch, dinner, and incidental expenses while on travel status and differs by travel location. The per diem is authorized only when overnight lodging is required. Travelers may receive per diem for meal and incidental expenses in accordance with the per diem rates established by the U.S. General Services Administration (GSA), which is based on the lodging location of the overnight stay. To view current rates, go to U.S. General Services Administration (GSA).

To verify the actual location of the stay, look for the city listed in the hotel address. This city should be used for the location on both the lodging and meal per diem expense lines.

The Amount field populates automatically with the maximum GSA per diem for the specified location.

Click Update if the Amount field does not automatically populate.

Per the OBM Travel Rule, meals provided by a conference are not reimbursable and should be reduced in accordance with the federal deduction standards held by the GSA.

The standard meal and incidental expenses allowance is based on a full day of official travel (twenty-four hours) within the continental U.S. Where overnight lodging is required and where a traveler is on travel status for less than a full day, the traveler must pro-rate the meal and incidental expenses rate for the departure and return days.

Meals and incidental expenses are authorized for state travelers only when overnight lodging is required and is either greater than 45 miles from both the traveler's residence and headquarters or greater than 30 miles from both the traveler's residence and headquarters for conference purposes.

Incidental expenses over $10.00 require receipts.

All incidental expenses must have a comment explaining the expense type and must not fit into another expense category.

Tips or gratuities for taxi, shuttle, public transit, meals, bellhops, housekeeping, etc., are not allowed.

An additional expense for each day of eligibility needs to be created to receive a meal per diem.

Meal per diems are prorated for the amount of time that a traveler is in travel status when the travel requires an overnight stay. The amount of per diem shall be adjusted on departure and return days based upon the time of departure and return. The times in the OAKS FIN Travel & Expense module default to reflect an entire day in travel status. It is the responsibility of the traveler to reflect the correct time that they are in travel status on their expense report (this is not required on the travel authorization).

To ensure expense reports contain the correct reimbursement amount, travelers must change the times on the meal per diem expenses to reflect the time that work-related travel started on the first day of the trip and the time that work-related travel ended on the last day of the trip.

Meal per diem times for days between the first and last day of travel do not need to be adjusted.

At times, meal per diems will need to be reduced (e.g., there is a continental breakfast that is free or a free dinner is given at a conference). Meal deduction amounts can be verified on the Meals and Incidental Expenses (M&IE) Breakdown.

Travelers can claim less than the meal per diems if desired.

The meal per diem is authorized only when overnight lodging is required. In OAKS FIN, the meal per diem amount for the date entered will automatically appear in the Amount field based on the lodging location. The meal per diem automatically reflected might also be adjusted according to the departure and return times entered.

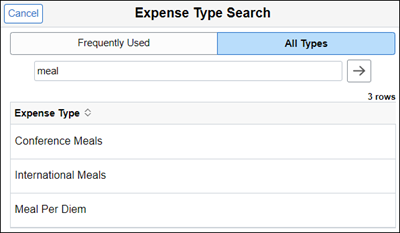

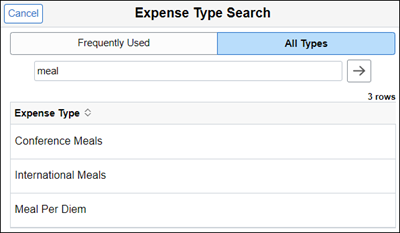

Use "Conference Meals" as the Expense TypeExpense Type instead of Meal Per Diem when a conference provided a meal that required a payment and the cost of the conference meal is higher than the per diem rate.

See Adding Conference Meals topic.